Inertia is real in the B2B golf world, and especially so in golf car fleet sales. Old habits die hard and relationships trump just about everything else.

Compete on price? Not so easy when the price per car is masked by a bid process that often included value adds like car accessories, gratis utility vehicles, financing wizardry and so on. A newcomer, even one with Yamaha’s impeccable cred, was SOL without a savvy partner to crack the code. Which is why they called us.

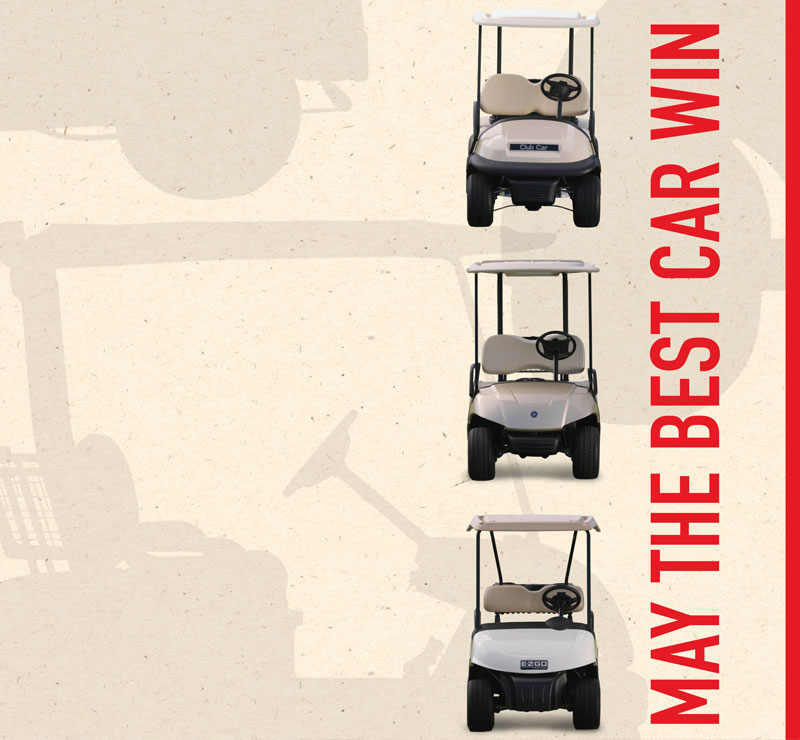

Market snapshot: E-Z-GO golf cars dominated the space for years. In the ‘90s, Club Car, after a number of product enhancements (and, ahem, working with BURRIS, forefather of 54 Brands) battled their way into parity. The two held over 90% of the market. Yamaha had the leftovers.

Winning Yamaha a seat at the bidding table was going to take more than clever advertising. We needed a disruptive sales strategy, too.

Our game plan: appeal to the target’s sense of fairness, argue that the car brand didn’t matter, the price mattered and, finally, on a level playing they would see which is actually the best car for their operation. They owed that to themselves, their ownership and their golfers. So May the Best Car Win.

It was ballsy. And it required Yamaha to step up and live the challenge, including showing up at sales calls with all three brands on a trailer so the prospect could test drive each.

The win spike was almost immediate for Yamaha and today there are three market leaders.

Winning Yamaha a seat at the bidding table was going to take more than clever advertising. We needed a disruptive sales strategy, too.